A Structured Approach to International Expansion

Deconstructing a framework and lessons learned from working across more than 50 countries

Hi there, it’s Adam. I started this newsletter to provide a no-bullshit, guided approach to solving some of the hardest problems for people and companies. That includes Growth, Product, company building and parenting while working. Subscribe and never miss an issue. If you’re a parent or parenting-curious I’ve got a podcast on fatherhood and startups - check out Startup Dad. Questions you’d like to see me answer? Ask them here.

Many companies struggle to push the button on international expansion. The world is a vast place and choosing the right market to start expanding to is fraught with complications. Today’s guest post by Scott Coleman will walk you through a data-based prioritization method for international expansion he’s leveraged across three separate companies at different points in time.

Scott has spent his career at the intersection of consumer technology and international expansion at Google, Pinterest, and Omaze (series C). He’s done work in over 50 countries, led teams of over 200, and was part of the team at Pinterest that grew to 450m monthly active users with 85% outside of the US. Today he advises venture backed companies on growth and international strategy (product, partnerships, marketing, operations). Find out more about his Reforge course, International Expansion for Consumer Tech.

International expansion is both exciting and challenging. It requires a clear, tailored strategy that depends on a lot of factors. Whether you're a small startup aiming to crack your first foreign market or a large corporation like Apple or Google looking to scale operations globally, understanding the nuances between product availability and market success is crucial. Many companies mistakenly equate localizing their products with guaranteed success, only to face disappointing metrics a year later. Today I'll explore why starting narrow and strategic is key, and how a simple, structured approach can help you navigate the complexities of international growth effectively.

Start with who you are

Set a simple strategy. Companies have different needs for international expansion depending on their stage.

Small companies (seed, series A, B) are still establishing product market fit. The goal should be to crack the next 1-2 markets outside of your home turf.

Mid-sized companies (series C, D, E) generally need to find product-market fit in multiple countries, 3-10.

Large companies (Apple, Google, Microsoft) can’t wait for products to slowly creep across the globe. They need to get a new product out to market quickly. Their problem is all about scaled operations.

I’d note here that I’m differentiating between product availability and market success. Product availability for consumer products is easy. Success is very hard.

You can localize your product pretty cheaply into 10 languages. But just because it’s available somewhere, doesn’t mean you’ll drive market success. MOST companies I speak with have found themselves 12 months later staring at localized products with sagging metrics and no idea why.

My advice? If you’re just getting started, start narrow.

Develop a country list

Write down countries that come to mind. While you’re doing this, think about why you’re choosing them. Fiji is an amazing place, but probably not the first country that you’d want to expand to.

As you comb through datasets, you may notice new countries that appear in the data. Add them in. This is an iterative process.

Leverage a simple framework

The simplest way to organize this is a three part prioritization framework. My background is political economics so I start using that lens and datasets that have become second nature.

The framework is organized into three dimensions:

Macro

PMF

Risk

Macro

Macro includes factors such as GDP, growth, and population. Over time I’ve found that GDP per capita is an important normalizing factor for consumer focused companies. This serves as a monetization proxy.

Growth rates are also important to consider especially since this exercise is typically focused a few years out. Europe may be a huge market, but is growing much more slowly than many parts of Asia and Africa.

Real data I’ve used to inform decisions:

GDP

GDP growth rate

GDP per capita

Population size

Population growth rate

For your product, you may find other macro indicators that are useful. Environmental startup? CO2 emissions are available. Energy? Electrical power consumption per capita. Healthcare? Fertility rates and life expectancy. The point is that there are plenty of macro level factors for any type of business. You can see a country summary here.

Product-Market Fit (PMF)

The hardest part is tuning the dataset to drivers of your product-market fit. It’s essentially the components of a TAM calculation but for consumer products, that can be any person on the internet. To narrow, add enabling factors.

In general there are a few benchmarks to consider and how this could work for an ads-based consumer company.

User growth TAM: # smartphone users

Monetization TAM: online advertising market

Competitors: # downloads from competitors / internet population

The recommendation here is to find 3-4 data-sources that really matter to create an enabling environment for your product.

Competition can cut both ways. In general, I view adoption of competitive consumer software products as positive. Your job is to find points of differentiation that will lure users to your product.

Adjust for risk

Many companies are great at sizing opportunities and have a harder time contextualizing risk. Sure, China is a huge market, but can you actually operate there? The World Bank publishes an ease of doing business ranking that can be quite informative as a start.

Other risk factors are specific to a given company. For example in the tech world these can be:

Regulatory: data localization laws, data privacy, GDPR

IP: risk of IP theft

Currency: currency fluctuations or inability to repatriate money

Bringing it all together

In the end you can calculate a score for each of these factors and assign them weights. You can do this at the individual criteria level and at the top level. Here is a spreadsheet with a model framework that was built for a real company (anonymized). In this version I up-weighted Product-Market Fit and Risk.

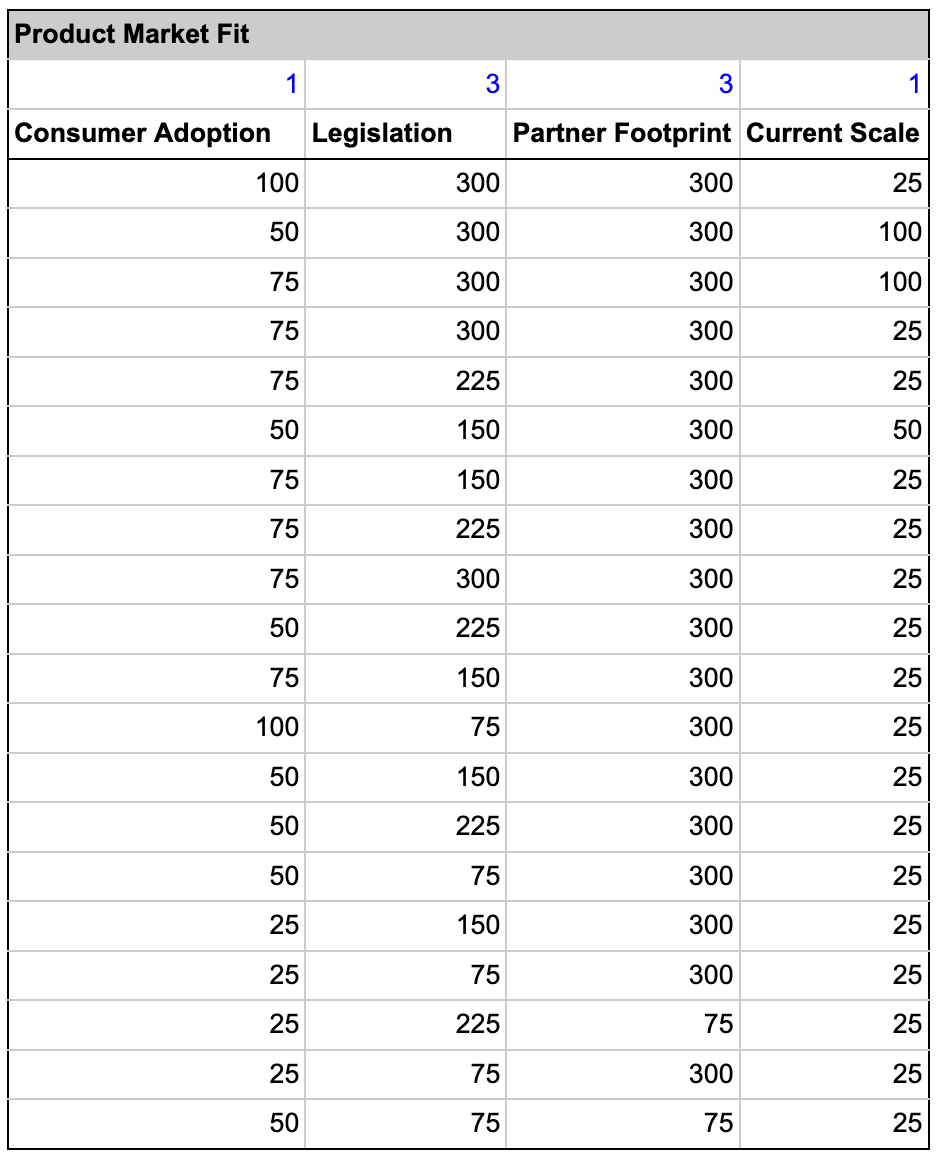

At the product-market fit level, legislation and partner footprint are core drivers of product success. In this version I’ve weighted these at 3x the current consumer adoption since the market is early.

Normalized data

Raw data input

Note that several columns use a coding scale of 1 -> 5. For areas that have less consistent data or rely on judgment, this is a simple way to inform your decision-making. You can be as precise as you want, but in my experience you’re looking for directional insight not splitting hairs on a couple of percentage points.

This also goes for dataset quality. You’ll find that some stats you get consistently across markets, others not. I’ve found that you’re better off having broader coverage, even if slightly inconsistent, than worrying about having every datapoint precise.

Data-informed, not data-driven

People love the idea of a data-driven decision. This means you do whatever the data says. For this exercise in particular, I prefer data-informed where data is one of many inputs in the decision-making process. I’ve found that intuition and qualitative factors can matter just as much as quantitative data.

What I advise people to focus on is:

What countries come to the top? Do they make sense? Do they make sense together? Does this match the intuition going into the exercise? If not, why not?

What countries drop to the bottom? Does this match the perceived opportunity? If not, why not? Is something off with the criteria?

Listen closely when speaking with experts and your team. When people disagree or offer comments, unpack what’s underneath that. It may lead to a valuable insight that would change your criteria or sorting methodology. They might have a different tolerance for risk (for example).

Wrapping It Up

To prioritize market entry, you can follow a straightforward process:

Create a baseline approach based on the stage of your company

Create a data frame to capture relevant ranking criteria

Use macro data sources for understanding the country

Find PMF proxy metrics that inform your operating environment

Add risk factors using a risk matrix

Adjust your criteria

Add qualitative insight into your decision-making

The template I’ve provided and the data inputs above should help you and remember to apply some critical thinking and qualitative judgment to your decision-making.

Editor note: in a future post I’ll be doing a deep-dive on Patreon’s international growth strategy from my time there. Subscribe today to make sure you don’t miss it!