Hiring your first Growth employee—Part 2: Competencies, questions and format, measuring success common mistakes, other resources

Plus dozens of interview questions and a pre-work template

Hi there, it’s Adam. 🤗 Welcome to my weekly newsletter. I started this newsletter to provide a no-bullshit, guided approach to solving some of the hardest problems for people and companies. That includes Growth, Product, company building and parenting while working. Subscribe and never miss an issue. Questions? Ask them here.

This is part two of a two-part series on how to hire for Growth. Specifically, how to make your earliest hire.

Part 1: The right time, the right archetype, the right interview process

Part 2: Interviewing, measuring success, avoiding mistakes, bonus resources ⬅️

In the first post of this series I covered the preparation for your earliest Growth hire, Now it’s time to turn the focus towards actually interviewing, hiring, and empowering this person.

In this second post I’ll cover:

An in-depth guide to interviewing: competencies, questions and formats

Measuring success for your Growth hire

Mistakes to avoid

Other resources on this topic

A downloadable interview pre-work template

Constructing an Interview Process

Step 3: Interview Process - Competencies, Questions and Format

(see Steps 1 and 2 here)

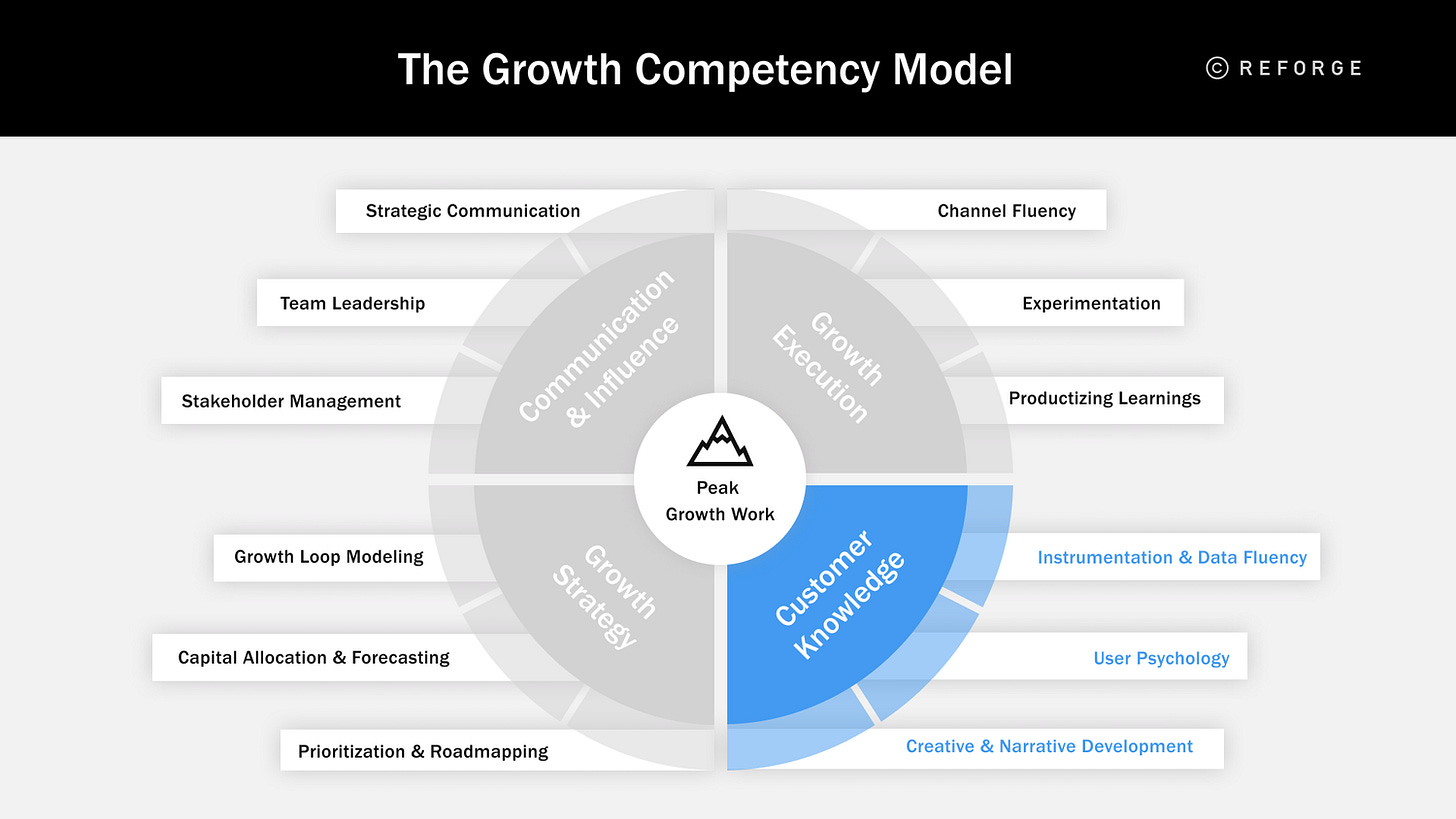

I’m going to propose the questions and format you’ll want to use for evaluating each of the 12 Growth Competencies. This is a tool, not a rule (h/t Ravi Mehta for this mantra) so I can’t guarantee you’ll be successful with it. It will, however, improve your odds.

Two additional reminders here: first, you’ll never find someone who indexes highly on all of these competencies. Don’t bother. We all have some areas of improvement and within the interview process it’s important to understand a candidates self-awareness of their improvement areas more than seeing mastery of all the competencies. Second, competencies are of varying degrees of importance as your career progresses. For this first hire you’d like to see people who score highly in Growth Execution and Customer Knowledge, with some elements of Growth Strategy.

Competency Group 1: Growth Execution

The three primary competencies under Growth Execution are channel fluency, experimentation and “productizing” learnings.

Channel Fluency

From my Competencies article:

“Growth requires an in-depth understanding of distribution and engagement channels to drive acquisition, retention, and monetization. Applying the wrong channel strategy, such as a Paid Loop when your product has a long and unpredictable payback period, leads to unsustainable growth and poor business performance.”

You’re not looking for an expert in each and every distribution and engagement channel. You want to find someone who can map channel strategy to the type of product that you have and understand that there is only a subset of channels available to you.

How do you test for channel fluency in an interview?

I have two preferred approaches to interviewing for this competency:

Situational interviewing

Hands-on assignment

In situational interviewing you can ask your interview candidates about decisions made in various situations at a prior company and add follow-on questions over time.

Here are some questions to consider:

Tell me about the growth model at Company X? How did that product grow?

Now, tell me about the acquisition channels you used. Which ones did you specifically work on?

Why did you leverage those channels?

How did you measure and monitor performance?

Tell me about a specific hypothesis you had about your channel and how did you test that hypothesis?"

Was it successful? Why do you believe it was?

Alternatively, was it unsuccessful? What did you learn from that experience?

You can repeat this for different companies, channels, and parts of the Growth Model such as retention and habit loops vs. acquisition loops. You're looking for the ability to understand why a particular channel worked well (or didn't) for a particular type of product.

In a hands-on-assignment I provide a take home (or live case study) and ask them to evaluate the channel strategy for a particular, well-known product. I specifically DO NOT make that case focused on my own company or product so as to not bias my evaluation. They'll never know as much about my company as an interviewee as I do as an interviewer. Instead, I prefer to use a product that is widely known and well-understood OR I ask them to pick the product.

Here you're looking for the ability to understand if they can identify the model at another company and de-construct the particular channels that *should* work for this business based on their product type. You're seeing if they can identify how a company has molded its product strategy to fit particular channels.

Experimentation

Experimentation is a critical tool in the skillset of a Growth practitioner.

But testing (get it? 😂) for this competency isn't just about seeing if someone knows how to run an experiment. That's far short of what is necessary to be successful in Growth.

This includes curiosity and hypothesis generation around the levers that drive your product’s growth, organizing and prioritizing those experiments to maximize learning, designing experiments, and analyzing results.

In short when interviewing for this competency: you need to know if someone can build an experimentation engine at your company.

There are three approaches for testing the Experimentation competency in an interview:

Live Case Interview

Prioritization Exercise

Learning “de-brief” Exercise

For a live case interview you can run this as a back-and-forth between the interviewee and interviewer. Start with context setting and lay out the situation:

"We define activation as 'X' and we're noticing a gradual decrease in our activation metric. You can see that in this graph. We've already conducted user feedback and they tell us 'A, B, and C' are problems. We haven't changed anything in our acquisition experience or channel mix."

Next, ask them to generate some hypotheses based on this context and follow-up with how they might test those hypotheses.

"Given this context; let's generate 4-5 hypotheses about what we believe to be true in our activation experience. Feel free to ask additional questions as they come to mind. Ok, now let's start with your first hypothesis -- how might you construct an experiment to validate or invalidate it?"

Finally, you'll want to introduce some new information or an outcome of that experiment and ask what they'd do next with this new information.

You're not looking for perfection but you are evaluating their approach. See if they ask you additional questions based on your context to further develop their understanding.

Here are some ways that you’ll know you have a person with a thorough understanding of experimentation frameworks sitting across from you:

Do their hypotheses reflect what the context you’ve provided around the quantitative and qualitative data?

Do they ask whether or not you've experimented in this area in the past and what you've learned?

Do the potential solutions they propose accurately test the hypothesis in question?

Are they able to articulate a statement of what they believe to be true and a structured way of testing for it?

Do they identify any "gotchas" or nuances to the structure of their experiment that shows they're thinking more deeply about controlling for additional variables?

In a prioritization exercise you want to see how they’d structure thinking around ranking a set of hypotheses and experiments.

You can start with the same context as the live case interview in order to simplify your interview approach. Provide them with a set of hypotheses that you’ve generated and some potential solutions on a board or a spreadsheet. Tell them that you want to understand how they’d prioritize this list of experiments and that you’re there to answer any questions they have.

Some thoughtful questions they might have include:

Tell me more about your past experiments - what have you learned from them?

What resources do I have available to me?

Do you have any particular Growth or Product principles that are important to the user experience?

What additional data do we have about X (where X is a particular hypothesis or area of the product)

As the output of this prioritization exercise you want to see that they have a framework for ranking the different hypotheses and solutions they’ll test. Are they ranking via Impact, Confidence and Effort (the classic ICE or RICE methodology)? Do they understand the cost of each experiment in human capital, time, and money?

A great output of this part of the interview is that you have an understanding of how the candidate would make decisions when faced with a myriad of potential options to choose from.

Finally, in a learning de-brief exercise you’re assessing the candidate’s ability to analyze and interpret results. At Patreon we had a section of our experimentation document called “If this works we should…” which articulated a few different paths forward if our hypothesis was correct. It meant that we were able to move swiftly once we analyzed results.

It’s important that your candidate be able to interpret experiment results and recommend a course of action. That could be a follow-up experiment, productizing the winning solution, iterating and releasing an improvement, or rejecting the hypothesis and moving on completely.

In this exercise you provide the candidate with a hypothetical (or actual) completed experiment, ask them to read through the document and describe what they learned and what actions they’d take as a result.

A great answer to this question will revisit the hypothesis and tell you whether it has been confirmed or rejected. They’ll follow up with a point of view on what you should do next based on these results. They should be able to give you their own version of “if this works we should…”

Productizing Learnings

As I mention in the Growth Comptency Model being able to turn an idea or simple experiment into a new product feature is extremely important. By default, a minimum viable experiment isn’t normally ready for a prime time audience. It might be built quickly, it might not scale, or it might not be the exact user experience you’ll want to release to everyone.

When interviewing for this competency you want to develop an understanding of how someone went from hypothesis to experiment to feature and of course what the results were.

One of the best ways to interview for this is with the behavioral interview technique. This is one of the most popular and widely adopted techniques that asks a candidate to provide a specific example from their past experience to illustrate a point.

Behavioral interviews often start with “Tell me about a time when…” questions, here is how I’d approach this:

Tell me about a time when you validated a hypothesis through an experiment?

What did you learn from this experiment?

What did you do next with this new information?

How did you and your team translate that new knowledge into a customer experience?

Tell me about the experience.

Did you change anything along the way?

What was the end result of those changes and this new experience?

Throughout each step you’re asking clarifying questions or asking for more and more specific information. You want to get to the heart of the underlying experience.

Here is how I would respond to this question based on a real example from my time at Lyft:

In the earliest days of Lyft (circa 2012) we didn’t have a referral platform and we didn’t have the people to build one; at least not without some validation. We also had a problem that when we launched a new market we would onboard many drivers to the Lyft platform had a cold-start problem with passengers. We wanted to see if we could find a way to leverage drivers to bring on some of our earliest passengers in order to get the word-of-mouth loop spinning.

Since we didn’t have available people to build a referral system we made a basic one using what we did have: Google Sheets and coupon codes. We gave every driver in Seattle a unique coupon code that they could use to offer new passengers a discounted ride. For every new passenger that redeemed their coupon and took a ride we would check to see which driver owned that code and we’d give the driver a cash bonus. We had all the tools to do these things independently but nothing was tied together – this was our minimum viable experiment.

The spreadsheet + coupon code experiment worked amazingly well. Drivers would find new passengers in their idle time and sign them up for Lyft. We were paying small amounts to acquire new, highly-valuable passengers in Seattle. We had real evidence that this was a high-ROI, low cost channel for us. We showed this to a few of our engineers and worked with them to figure out how to turn this into a product experience with a web flow for drivers and a direct download link for passengers (still not embedded in the app yet).

This next phase was also wildly successful and even easier for drivers to use. We were able to show these results, that drivers could be an answer to our cold-start problem, and then build the experience into the Lyft driver (and eventually passenger app). The financial viral loop created by referrals became a dominant channel for Lyft’s early growth – generating over 40% of our acquisition at a very low cost. Over time we evolved this product to introduce other forms of referral (like drivers referring drivers), variable incentives, short-term incentives, and much more.

Now that we’ve covered interviewing for channel fluency, experimentation and productizing learnings let’s move on to Customer Knowledge.

Competency Group 2: Customer Knowledge

The three primary competencies under Customer Knowledge are instrumentation and data fluency, user psychology and creative and narrative development.

What you’re assessing throughout the customer knowledge interview is whether the candidate has a depth of understanding about what is happening with customers or prospects and why it’s happening.

Instrumentation and Data Fluency

A successful candidate will have a strong understanding of qualitative and quantitative data, the tools used to extract that data, and the infrastructure necessary to support it. You don’t have to be a SQL expert or run Python scripts in a Jupyter notebook to be a great Growth practitioner.

You need to see if a candidate can understand what they want to track and succinctly explain how they plan on doing so. And there’s a very good chance the audience they’re explaining it to won’t have a clue about the technology so they should be able to ELI5 it.

There are a few ways to test for this in interviews:

The behavioral interview

The situational interview

The take home case

In one of my first jobs ever I was interviewing for a Marketing Analyst position in charge of the performance of a single channel. In the interview I was asked about my knowledge of Excel. When I said I’d give myself an 8 or 9 out of 10 the follow-up was to write a VLOOKUP statement on the whiteboard. This is not a great set of interview questions to test data fluency. Don’t do this.

I’ve already covered the behavioral interview structure above, so here is what a hypothetical set of questions might look like for this competency:

Tell me about a time when you didn’t have the proper instrumentation to get all of the quantitative data you wanted; what did you do?

What analytics tools are you most comfortable with?

Tell me about a time when you used that tool to identify what was happening in a product (or marketing) experience?

How did you find out why it was happening?

Tell me about a time you realized you didn’t have sufficient data to understand an experience – how did you get that fixed?

Tell me about a Growth loop you have in your current company; what are the steps of that loop and how do you measure it?

You’re looking for an answer that shows a practical understanding of data, a structured approach to analysis and filling in the gaps, the ability to leverage tools and technology to get to the truth, and the ability to ELI5 an approach to instrumentation.

In the situational interview you’re dealing with hypotheticals and future scenarios. The common approach to this is to use questions that begin with “Tell me how you might…” Here are some sample questions you can ask in this type of interview:

You notice that a key part of one of your Growth loops isn’t instrumented; could you explain how I might approach doing that in whatever tool you’re comfortable with? You can specify a type of loop here to guide the candidate.

What would you do in a situation where an experiment yields inconclusive results?

In our weekly business review we notice that activation rate is dropping; how might you diagnose this?

What do you do in a scenario where you have a gap in your quantitative data?

With these answers you’re looking for something similar to the behavioral interview answer. Remember that an answer that talks about what someone would do in the future is never as good as asking about something they actually did in the past. Unless of course you want to understand what they’d do differently. For this reason I often prefer the behavioral over the situational.

The take home case has become one of the more controversial forms of interview, but I think it’s still an important one. It is controversial for a few reasons:

Companies are bad at structuring them to simulate an on-the-job experience.

They can take too long and become overly burdensome to the candidate.

They focus on the current company which biases the reviewer because of an information imbalance.

I like the take home case because it removes the burden of a stressful interview situation and gives people focused time to work through a problem. This is what their job will be like. There are also some people who just don’t perform well in interviews despite being quite talented.

One take home case that I love is around evaluating retention curves. I like to provide candidates with a hypothetical data set for a made-up company. This data is obviously organized by cohort and has a few different tabs: one that is time based, one that includes segments, and one that shows cohort charts and retention curves. There should be several (at least 10) obvious anomalies with the data that could pique someone’s curiosity.

The prompt is simple: identify three interesting takeaways from this data, what your observations are, and what hypotheses you would generate from these observations.

You’ll also want to provide a time-box for a candidate – don’t spend more than 90 minutes on this to avoid controversy #2 above.

User Psychology

A Growth candidate who really understands user psychology will have a foundational understanding of what motivates and shapes customer behavior.

You’ll want candidates who know the elements of habit formation and that user acquisition requires balancing emotion, logic, motivation and reward. Reforge has a resource on this called the ELMR framework as part of the Growth Series.

For testing this competency I prefer a live case study (you can also use the take-home case study mentioned above).

To structure this you could have a candidate build a use case map with you for a product. The use case map is a straightforward table that takes a single product and identifies the user problem, persona, alternatives, why a user would choose your product, and the natural frequency of usage. This is lays a foundation for understanding the psychology of choosing a product.

From the Use Case Map you could have the candidate dissect a particular landing page or a user flow (like onboarding, for example). Ask them questions such as:

Who do you think this experience is targeting?

What emotional reaction are we tapping into here?

What logical appeals are we making on this page or with this experience?

How might you improve this page to better persuade a visitor?

Creative and Narrative Development

Understanding how to talk to different audiences in a unique way builds on top of insights gained from other aspects of Customer Knowledge. The users of your product are increasingly diverse with different needs, motivations, and challenges. If you can communicate effectively with these users you’ll be better positioned to acquire, retain and monetize them.

A skilled Growth practitioner knows how to conduct messaging and creative testing via experimentation, surveying and other forms of research.

In order to test for this you can use a combination of behavioral and situational questions. Recall that in the behavioral interview you’re asking about their past, lived experiences and in the situational interview you’re asking about a hypothetical future scenario.

Here are a set of questions for structuring the behavioral interview:

Tell me about the different user personas for your last product.

How did you identify these different personas?

Okay, pick two – could you tell me how their needs are different?

How did you determine that they had different needs?

How did you address these different needs?

Did you communicate with them differently? How?

A great answer to these questions will step you through the nuances of two different user types with a focus on how you spoke to each group.

Here’s a hypothetical example of how I might answer this if I were working at the cloud storage company Box:

At our company we have a few different user personas organized by the types of problems and questions they have about the product. Some users care only about the safety and security of our file hosting solution; others care about version control and management, and others care about easy file sharing.

We’ve learned this through a series of customer interviews with different types of users – the administrator, heads of security, and people in creative departments like graphic designers.

One of the ways that we communicate differently with them is in our user onboarding. Based on what brought you to the site and specific landing pages we will re-orient the onboarding flow to highlight the specific product features you’re looking for. We’ll specifically change the first actions that someone does based on their needs—for example we might have someone who cares about version control upload a file, modify it, and roll it back to the previous version as part of their onboarding.

This has improved our activation rate in onboarding by 22%.

A poor answer to this question won’t indicate any understanding or past experience with user personas, messaging and experience changes, or alternative positioning.

Now that we’ve covered interviewing for channel fluency, experimentation and productizing learnings let’s move on to Growth Strategy.

Competency Group 3: Growth Strategy

In my article on Growth Competencies I define Growth Strategy as the long-term view of how your company grows, invests in growth, and will need to adapt in the future to continue growing.

For new Growth hires you won’t necessarily find an expert at this competency group (or Group 4 which is Communication & Influence). That’s because these tend to be competencies that are developed and improved as you become more experienced.

The three specific competencies within Growth Strategy are Growth Loop Modeling, Capital Allocation & Forecasting, and Prioritization & Roadmapping. I would expect a new hire to be able to model scenarios and create forward-looking forecasts as well as apply frameworks for prioritization. You probably won’t find someone who is an expert at Capital Allocation with this first hire and that’s okay.

Combining Growth Loop Modeling, Forecasting and Prioritization in a single interview

The ability to construct a qualitative and quantitative model of your Growth Loops (how you grow) are the most critical pieces of your Growth Strategy. But with your earliest hires you and other leaders should have already done this work as we discussed in the first part of this series.

For this set of competencies it’s not necessary to test them separately. You can consolidate them into a single interview slot. This can be a good one for the hiring manager to run since you’ll be spending time on Growth Strategy alongside this new hire.

There are a few good approaches to this interview—the behavioral interview, live case study, or prioritization exercise are all ways to test these competencies.

In the behavioral interview you’re going to ask questions like:

Tell me about the [acquisition or retention] Growth loops at your company.

Let’s pick one - tell me more about this loop what are the steps and how have you worked on it?

How did you identify those opportunity areas?

Why did you prioritize working on this?

Can you tell me about the performance of the loop and how it impacted Growth?

In the live case study you can provide the candidate with a map of your Growth loops or your quantitative end-to-end Growth Model (or a hypothetical one) and ask them to walk you through what areas of opportunity they see and why. It’s important that you keep this simple enough so that they can evaluate and make decisions in the interview. You’re not trying to stump them you just want to see how they process this information and make those decisions.

You can combine the behavioral interview or case study with a prioritization exercise. In the above examples you’d add questions like:

Tell me about a difficult prioritization decision you had to make at your last company - how did your Growth Model inform that decision?

How might you decide which areas of opportunity you’d work on here?

What other information would you need to make these decisions?

Great answers to this interview will articulate an understanding of how the inputs of a business drive the outputs of a P&L. A candidate might say that they made certain decisions to improve a specific metric (early retention rate, or activation, or signup rate, etc.) and that doing so would lead to a certain amount of incremental revenue. They’ll also tell you that they prioritized based on some combination of product strategy, business impact, and modeling.

Remember, these competencies are developed as a candidate’s experience increases so you’re not looking for someone with expert-level mastery at this point in time.

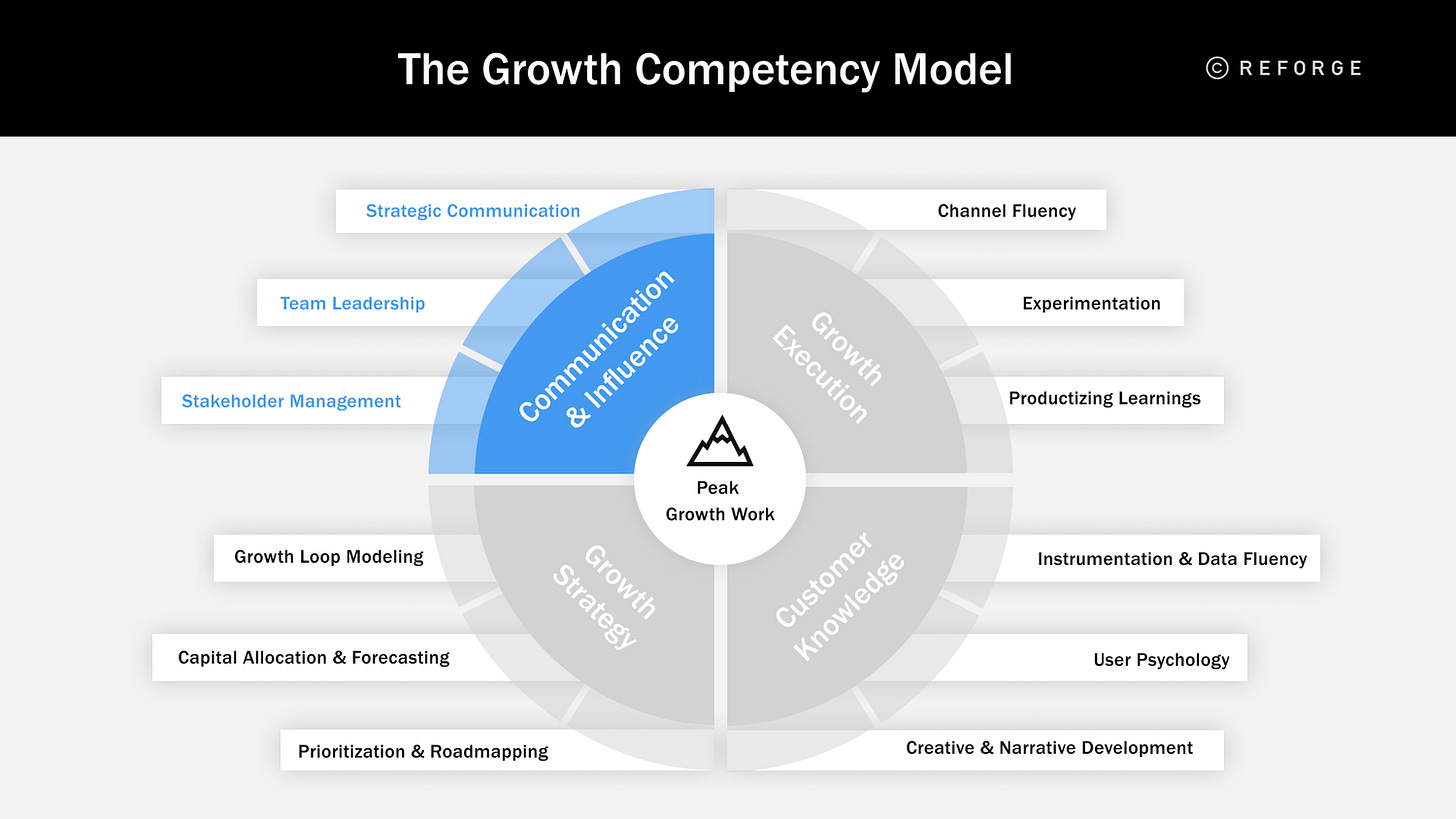

Competency Group 4: Communication & Influence

Similar to Growth Strategy, strong Communication & Influence skills are developed across many years of work experience.

From my Growth Competencies article:

Even if you have the best data and ideas you still have to convince others on your team and cross-functional teams to pay attention and get behind those ideas. Just because you believe you’re right doesn’t mean everyone else sees it that way.

The three competencies within this group are Strategic Communication, Team Leadership, and Stakeholder Management.

If you’re following my advice in the first part of this series you probably won’t be hiring a seasoned manager just yet. However, the ability to communicate what the team is doing and rally others to your cause is very important for this first hire.

I would test all three of these competencies with behavioral or situational interview questions:

Behavioral

Tell me about a time when you held an unpopular opinion and had to convince someone to work on it?

Tell me about a particularly difficult stakeholder you’ve had to work with?

Do you have an example of a time when you didn’t communicate as well as you could have? What did you learn from that experience? What do you do differently now?

Tell me about a time when you had to explain your roadmap to someone and they weren’t happy with the sequencing?

Situational

What would you do if I (your manager) disagreed with your prioritization but you believed it was right?

How might you explain a “failed” experiment to our CEO?

What are the different types of communication you might use (written, meeting, Slack, etc.) for different situations? Why?

A great answer to these questions demonstrates experience in dealing with challenging stakeholders, a framework for dealing with conflict or difficult conversations, and an understanding of when to use the various mediums of communication. You’re also evaluating how they explain this to you in the interview as part of your assessment—is the story clear and compelling? Does it answer your question? Does it represent the appropriate level of humility and empathy (assuming that’s important to you).

So now that we’ve completed our interview process and successfully made our internal or external hire it’s time to set your new hire up for success.

Setting up and Measuring Success

A new hire has a lot of initial momentum and political capital when they join because they’ve just made it through your hiring gauntlet and you’re really excited to have them here. Their first month on the job is absolutely critical to their long-term success. You could compare this to the work we do around the “activation experience” when we’re trying to drive long-term retention. This is the activation experience for your company.

I’m a big fan of the book “The First 90 Days” which is provides frameworks for someone who is entering into a new role and helps them set themselves up for success. In a future article I’m going to provide the template I use for myself when starting a new role.

As the hiring manager make sure that you have a clear and agreed-upon 30/60/90 day plan that other people are also aware of. You build this together with your new hire.

Broadly speaking it looks like this:

Month 1 is learning, building relationships and evaluation of the situation.

Month 2 is development of your prioritized backlog to test Growth Model assumptions.

Month 3 is execution and communication

A lot of the best people I’ve worked with have started on Day 1 with a plan because they did some homework and learning up front. They come in and they’re asking really thoughtful questions – they’ve probably already done this during the interview process too by the way. And they move fast to implement because with Growth time is of the essence. By the time they’re in their 2nd month they have a plan for what they’re working on.

Plan to spend a lot of time with your new hire in the beginning to help accelerate their learning curve – many hours per week. It’s crazy to me that some founders don’t spend much time with their new hires that they just spent countless hours in the interview process with.

Measuring Success

With the best hires you can measure their progress in days and weeks, not months or quarters. One qualitative signal is that they’re really good at building relationships so you hear a lot of positive feedback from people who are interacting with them.

From a tactical perspective they have to own the growth model right away and start to build a deep understanding of your customer base through quantitative and qualitative data. You want them digging into and building the process for how to develop new knowledge of your growth model, identify constraints and test levers within it to overcome those constraints. They need to own the experimentation process (and create it if it doesn’t exist) – which includes improving rest of the organization’s knowledge base.

The most straightforward approach is to use that 90 day plan to set key benchmarks of success with key, weekly deliverables.

Here is an example (with names removed) from a role that I had.

If I’m not seeing tangible progress on the above or the person seems rudderless—doesn’t know where to start and really needs me to help them prioritize the basics—then I very likely haven’t made a good hire or it’s time for some very direct feedback.

I generally give my new hires those ninety days to find their footing, make solid recommendations and get alignment with me and others. I like to see them get a few small wins in that time too. It could be making changes to something that was broken, tweaking our Growth Model, or pulling a new insight from our data or from speaking to a customer.

I don’t expect them to transform our Growth in ninety days. Real, authentic, sustainable growth takes a long time and a series of iterations and improvements, but I want to see early on that you can do what you say you’re going to do (create and execute against a plan). If they can do that the big wins will come.

I want to end with addressing some of the most common mistakes I see founders make with their first Growth hire.

Top 10 Mistakes to Avoid

Not only is this a list of the mistakes I so often see founders and leaders making with respect to hiring for Growth; it’s also some mistakes I have made along the way.

Hiring too early for Growth

If you don’t have Product/Market Fit you really shouldn’t be hiring for Growth. You run the risk of onboarding a lot of new users and churning them out just as fast.

Hiring too late for Growth

The opposite can also be true. If you’ve waited too long and your organic Growth has stagnated then you’ll panic and expect too much with too little time.

Expecting transformation in a short time horizon

Growth is a long game. It’s not made up of hacks (more on this in an upcoming hot take alert). If you expect your new hire to deliver eye-popping results right away you’re going to be deeply disappointed. They’ll come, but it takes time.

Hiring the wrong archetype

As tempting as it is to hire The Painter first to build your vision and team, don’t do it. You need someone who is process oriented and great at executing. That’s The Architect.

Hiring the wrong type of experience

Hiring the marketer when you need the product person. Hiring the product person when you need the marketer. This is one of the biggest areas that leads to rapid hiring and firing (or quitting). The person/role fit must match up for magic to happen.

Prioritizing an external hire over an internal one

Most of the time you’ll be better served moving an eager, internal, motivated employee into your first Growth role. They’ll have the business and customer context necessary to move quickly. You can hire an external person, but see Mistake #3 and be patient.

Hiring without data

Similar to Mistake #1, if you don’t have a robust understanding of your loop and models, rooted in data, you’ll be setting your new hire up for failure. This is further exacerbated by Mistake #3 and your expectations around progress. This will be very, very slow if you don’t yet have the data and instrumentation necessary to make decisions and evaluate experiments.

Pattern matching

Repeat after me: just because Facebook did it one way doesn’t mean we should too. This mistake often goes hand-in-hand with Mistakes # 4, 5, and 6. Don’t get woo’d by the overly-experienced, smooth talking, experiment-on-one-billion-people Meta/LinkedIn/Snap/Workday/fill-in-the-blank-unicorn-company Growth person. Your company is different, your users are different, your data is different, and what works will be fundamentally different. Pattern matching often leads to lots of motion with little progress.

Lack of onboarding

Great interview processes take a lot of preparation. So do great onboarding experiences. The first few months on the job create a long-term impression of the company and will make or break your ability to retain a great employee. Don’t skimp on the work involved to build a great employee onboarding experience.

Internal alignment

Make sure your leaders know why you’re hiring for the role and what the expectations are. Even better if everyone at the company is aware. I’ve seen internal confusion about the role of a new hire really undermine the employee’s ability to make progress on their early goals.

Other Resources

I’m not the first person to write about this topic nor will I be the last. I want to provide some kudos and links to those who have helped leaders solve this problem already. Many of them are friends and/or professional colleagues of mine. They are brilliant and you should read everything they write. This is definitely not an exhaustive list but some of my favorites.

In no particular order:

Lenny Rachitsky and Elena Verna - Six rules of hiring for growth

Jeff Chang - How to structure and hire a high-impact growth team

Yousif Bhaijee and Scott Tousley - Hiring the wrong growth leader

Anu Hariharan - Building a growth team according to Y Combinator

Casey Winters - How to hire a head of growth

Hila Qu - How to make your first growth hire

In the future as part of your annual Reforge membership you’ll be able to take a program on Growth Leadership created by me and Elena Verna. We’ll cover many of the topics in this series in greater detail and with interactive case studies.

And I mentioned I’d be sharing a “pre-work” interview template in part 1 of this series. You can download that here:

hey adam - any rough ideas on when this course will go live on reforge? I know these courses are super expensive, but getting to hear about real case studies from you and Elena might just be worth the spend.