How to set up a Weekly Business Review

Getting your company and teams better at understanding and moving metrics

Hi there, it’s Adam. 🤗 Welcome to my weekly newsletter. I started this newsletter to provide a no-bullshit, guided approach to solving some of the hardest problems for people and companies. That includes Growth, Product, company building and parenting while working. Subscribe and never miss an issue. I’ve got a podcast on fatherhood and startups - check out Startup Dad here. Questions? Ask them here.

Q: You’ve talked about the Weekly Business Review before—how do you set up and run them? Is it per team or across teams and how do we make them actionable?

I’ve written a few newsletters now on the importance of measurement and metrics in product work. Last week’s Motion vs. Progress Hot Take and Evaluating Product Investments are important reading to accompany this newsletter.

Much has been written about what happens at a Weekly Business Review (or WBR). The authors of Working Backwards, Colin Bryar and Bill Carr, have a chapter devoted to Amazon’s WBR in their book’s metrics section (“Managing Your Inputs, Not Your Outputs”). Google has a good summary of it here. Actually, there are about 316 million summaries of it and Google has organized them all. Unfortunately, I found that although it’s a great read it didn’t really give you a playbook that addresses the questions above.

So, this isn’t a regurgitation of Amazon’s WBR. Instead, I’ll answer the question about how to:

Set up and run a Weekly Business Review

Manage them within and across teams

Make them actionable

Why run a Weekly Business Review?

Before I dig into set up, management and results I want to briefly touch on why you should have one. This is important because you need to know the problem that WBRs solve so you know if it’s worth it to implement one.

Here are a few problems that a well-run WBR can help you solve:

My organization is not metrics oriented

We don’t know what levers move our business

Teams don’t feel accountable for results and moving metrics

Limited leadership visibility into business performance

We’re focused on the wrong things (lagging outputs rather than inputs)

We’re missing or beating our goals

We focus on metrics but are very reactionary to changes

The bottom line is that a WBR shines light on the important metrics of the business which forces attendees to understand what’s happening (and why) and manage the results. It helps you identify trends and aberrations in your business before they become systemic problems.

Sound great? Let’s talk about how to set up and run them.

Set up and Run a Weekly Business Review

The goal of your WBR should be to bring accountability and attention to the most important input metrics of the business and those who own them.

An input metric is one that you or a team has influence on—for example, the number of high-quality signups, views of a product detail page or 7-day retention. An output metric is the corresponding, downstream impact of the fluctuations in that metric—transactions, revenue, or GMV to name a few.

I’m going to assume that you have your data house in order and inputs are instrumented properly. If that’s not the case then I recommend taking a course like Data for Product Managers from Reforge or something similar. This newsletter won’t dive deep into that topic (maybe in a future one, but not today).

Build Qualitative and Quantitative Growth Models

If you don’t have a clue about how you grow then your first step is to build a qualitative and quantitative growth model for your business. Start by letting leaders in your company know that you think it’s important to build an actionable understanding of how you grow and ask for their help in getting there. You’ll want to assemble a small group of data-forward people to do this work and if your company culture isn’t data-oriented then you may have to do this work in the “swing shift” or in off hours to get started.

People you’ll want to recruit include: analyst(s), other PMs, finance, and marketing. When you bring this folks together the questions you want to answer are:

What macro business metrics does our leadership and board care about?

How do we acquire new customers; through what loops or channels?

How do we retain customers; what loops exist in our product that reinforce habits and keep customers around?

What other ways do people discover our product(s) even if they’re not “loops?” These are your linear investment channels.

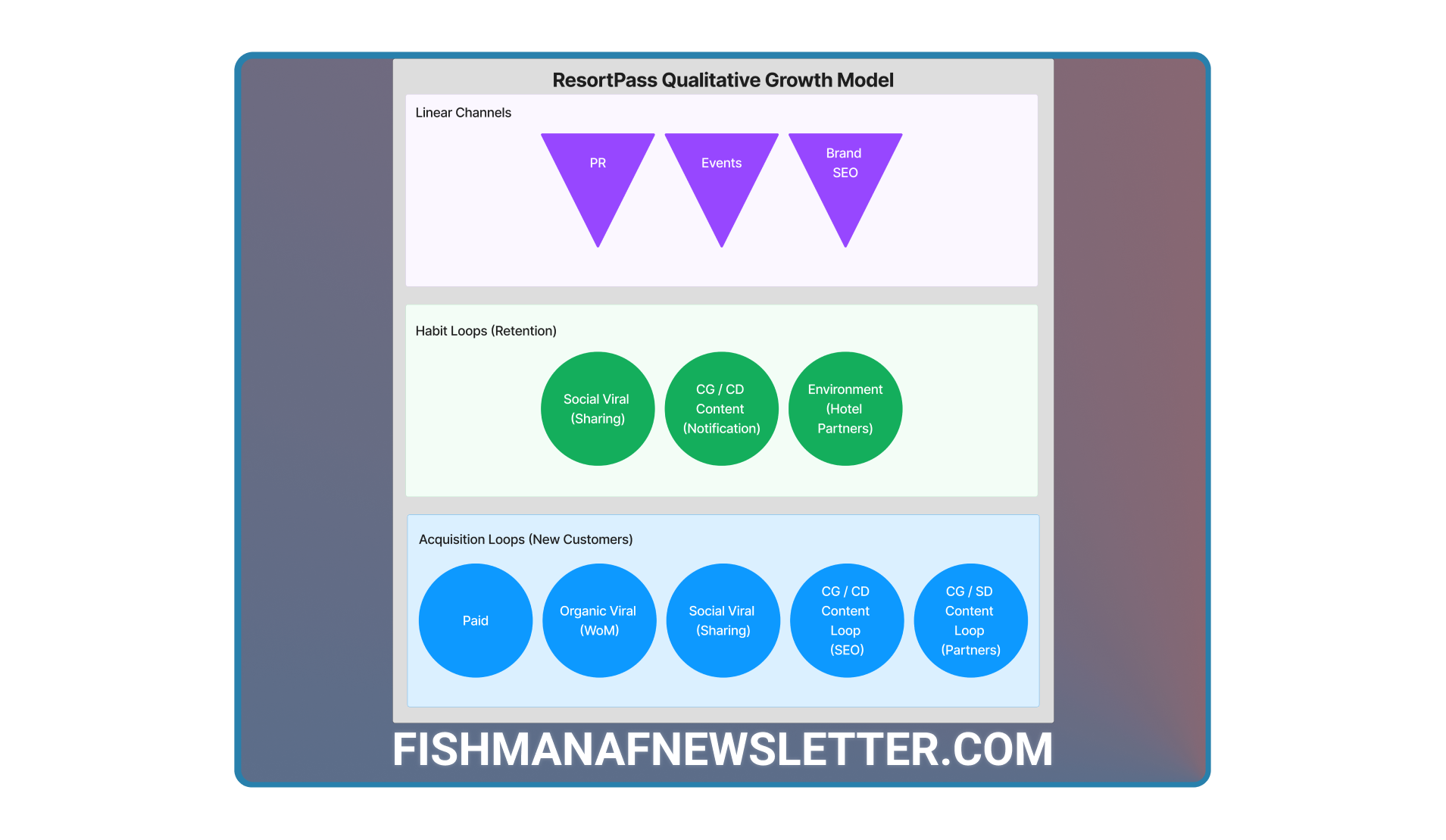

All you need to do in this first step is identify and bullet out these different levers. Let’s use ResortPass as an example.

Here is a sample of the ResortPass Qualitative Growth model on the consumer side. If you’d like to play around with a template you can access that here.

Notice how simple and straightforward this is. No need to overcomplicate it at this stage because you’re optimizing for clarity.

Once you’ve got your small group aligned on this visual of how you grow you should confirm it with other leaders—marketing, finance, product and data are good groups to start with. They may have some additional feedback that you hadn’t considered and you’ll want to incorporate it. Remember though, don’t take a kitchen sink approach here. Keep it simple!

Once you’ve got your Qualitative Growth Model you can start to build out the pieces of your Quantitative Growth Model. One of the best explanations I’ve seen for this is Phil Carter’s Reforge Artifact for Quizlet’s US-based Growth Model.

The goal of the Quantitative model is to put metrics to the components that make up your various acquisition loops, retention loops and linear channels. These are the elements that you’ll focus on in the Weekly Business Review so it’s a good idea to get them all documented with their current and historical baselines.

Once you have a working Quantitative model that your small team can agree on, it's time for another roadshow. I’ve written before in Evaluating Product Investments that your Finance team or “FiF” (Friends in Finance as I call them) will be one of your best allies in moving to a more data-informed culture.

This is because these are the people who report on the major output metrics of the business and they have a keen interest in understanding what drives fluctuations in those metrics because it makes them more accurate forecasters. And everyone loves an accurate forecast, especially your CEO.

So start with Finance and walk them through your quantitative model making sure to focus on how the pieces of the quantitative model lead to the outputs that the business cares about. Your marketing and product leader(s) are also good people to involve at this point.

If you handle these conversations correctly, and you have historical data in your quant model, then you can point to specific changes that resulted in a downstream impact on your business. And this is where the eyes of the executives start to open. They’ll want to know how you can operationalize these insights. Checkmate.

Once they want to operationalize it you’ve won the first battle of implementing the Weekly Business Review and you’re ready for the next phase.

Managing them within and across teams: who attends and how to operationalize

One of the important aspects of the WBR is when you have it and who attends. I’ll cut through the crap and make two very specific recommendations – this assumes you have a normal business without any weird, weekly seasonality and you track Monday - Sunday as a week.

First, your WBR should be on Tuesday mornings. The reason for this is simple: on Monday teams can assemble and look at the WBR metrics from the prior week ending Sunday. They can comprehend and socialize (within the team) what’s going on and why.

By discussing within an individual team the entire team develops expertise on the performance of their metrics and what drives them. This means that the delegates from the team come into the Tuesday WBR fully prepared to discuss any positive or negative aberrations and you don’t waste any time.

Second, your WBR should include the following at a minimum: Product Managers of your various teams, Marketing counterparts, Finance representative(s), Analysts, and a few critical C-level executives, or those who hold the highest positions in the following functions: product, marketing, finance and the CEO.

You can also have a representative from Sales there (if you have a Sales team) but they’ll also likely have their own pipeline reviews and they won’t be influencing product and marketing metrics though as you’ll see below they could be a beneficiary of them.

So tell all of those people, starting with the leaders, that you’re going to run a Weekly Business Review and the goal is to establish a deep understanding of the individual metrics and levers that influence your business. Then schedule it. For Tuesday morning.

Give yourself an hour (Note: sometimes this ends up being a longer meeting depending on how big your company is, but start with an hour). Make absolutely sure that if you’re scheduling for Tuesday morning the expectations of the meeting are known; especially that people need to show up prepared which means team-level review on Mondays.

So what are you assembling from a metrics perspective?

Take your Quantitative Growth Model and build historical trends for all of the key metrics you included in that model. It’s best to build these out in a tool that automatically refreshes and can show you different time periods. Visualizations (i.e. graphs / charts) are critical. They make it easy to instantly spot trends and you can also layer in targets on top of them to see if you’re approaching or receding from your goals. The time periods that you should consider are trailing 8-12 weeks and trailing 14 days. This gives you visibility into a zoomed-out view of the past quarter’s performance as well as a zoomed-in view of the last two weeks.

I’m generally agnostic on the display mechanism (spreadsheet, slide, analytics tool, etc.) but my recommendation is to use the one that requires the least amount of busywork to assemble. That tends to bias me towards 1) Cloud-based spreadsheet or 2) Analytics tool. I don’t really like slides; they feel performative. But if you’re a slide-oriented company; go forth! Better to do something than nothing.

Most of the metrics gathering and display can be automated by a savvy analyst or data scientist as long as you’ve got your data house in order. At ResortPass we use an automated spreadsheet. At Imperfect Foods we used Google Sheets and trended data and at Patreon we used Amplitude and Mode.

All of these are fine so long as you’re focused on the right metrics and seeking the truth. This brings me to my next point:

What should we be discussing?

For a majority of your metrics, you’re probably not discussing anything. You’re flashing past it on a screen and saying “Nothing to see here; trend is normal.” That’s because it’s not worth the cost of the meeting to discuss every single chart and graph. As I mentioned above, focus on aberrations. These can be negative OR positive aberrations, but they’re something that stands out from the historical trend.

When you spot one of these or ideally when a team brings it to the attention of the room the collective goal of the room is to get to the core truth of what’s happening. This means you pause at the aberration and talk about what you’re observing and what you believe is causing it (hypotheses).

For example, if one of your product teams is in charge of customer activation that could manifest in a metric like new trials activated and 7-day free to paid conversion (i.e. how many are still active from that cohort after 7 days). You might see that new free trials have spiked but 7 free to paid conversion has dropped. Maybe you’re running an experiment with a simplified onboarding flow and that has led to an increase in those new trial numbers but it was so simple that they didn’t reach an “aha moment” and thus aren’t as likely to be active after 7 days. This would be something to both callout and state your hypotheses for. You’d also identify the need to address this and an action to follow up with new, testable hypotheses outside of the WBR.

For other attendees, this insight could be incredibly helpful. Remember above when I mentioned that Sales might be a beneficiary of another team’s metrics? Maybe the sales team has an assist group who reaches out to customers just before their trial expires and that team has been less successful over the last week. Now you know why. You’re getting to the truth.

Nowhere was this shared metrics understanding more important than during the start of the COVID pandemic.

Here are a couple sample charts from Patreon WBRs that illustrate the changes we were witnessing right at the start of the pandemic. Notice the huge spike in a few of our metrics. We were able to pinpoint and project the impact COVID was having on our business and weren’t surprised by it because we were running a WBR.

So you’ve set up and operationalized your WBR, but now how do you make it drive results?

How to make WBRs actionable

There’s no way around it: the WBR is an expensive meeting. If you’re not familiar with that term, let me explain. A meeting is “expensive” when the cost of the attendees (in salary, etc.) is high. Meetings that have many attendees or several senior attendees are therefore expensive. If you know me at all you’ll know that I hate wasting time in meetings. I had a mini rant on a similar topic about a month ago.

So if we’re going to have this really expensive meeting it had better be a good one.

At Patreon we had two goals and four principles for our WBRs and QBRs.

Goal 1: Discuss important trends that would benefit from higher visibility and discussion.

Goal 2: Provide a venue to review and ask questions about Patreon’s growth and performance against company objectives.

Principles:

Not duplicative of other meetings.

Relatively easy to compile and review material.

Efficient use of time (highest value: it feels fast, is organized and has a clear agenda).

Engaging

Much of this stemmed from three of our core behaviors: achieve ambitious outcomes, respect your teammates' time and be candid and kind.

Aligning on goals and principles is a good start to an actionable meeting.

The second way to make it actionable is to avoid discussion on areas that don’t need to be discussed. For example, as mentioned above, if you’re reviewing hundreds of metrics and there are no aberrations in many of them then don’t discuss those. Skip them. You want to exert your energy on the metrics that are bucking the trends (good or bad) because those are the ones that need fixing or further investment.

The third way to make it actionable is for metric owners to do their homework ahead of time. If everyone knows what’s going on in their respective areas then they can come prepared to explain and discuss hypotheses. If this isn’t happening then it’s a good point of feedback from a manager (or peer) to a team member.

The fourth way to make it actionable is to avoid wasting time on solutions. This meeting shouldn’t be performative, it should be about curiosity and discovery. That’s why I don’t recommend slides. Time should be spent on hypothesis generation, follow-ups and owners.

A fifth and final way to make this actionable is to iterate and evolve the metrics reviewed. Just as a growth model evolves over time, so does a WBR. If you realize that a particular metric or set of metrics trending in a certain direction doesn’t actually have any bearing on the outputs you care about (customers, revenue growth, etc.) then own up to that and make a change. You’re only helping the people in that room if every metric you discuss is one that matters to the business.

Finally, I’d be remiss if I didn’t also include some pitfalls to avoid in a WBR as I wrap up.

Conclusions and what to watch out for

One of the common criticisms of a Weekly Business Review is it is intensely focused on the near-term, week-to-week machinations of the business. Most product building, people will argue, needs to take a long-term view and may not have short-term implications. Others will argue that a ruthless focus on metrics ignores the customer feedback that, if addressed, will make customers lives better but may not necessarily move a metric.

Both of these can be true and are exactly why you have a Weekly Business Review.

Most long-term work has short-term manifestations: experiments, fixes, iterative releases. Those will have an impact on the metrics you track in a WBR. The only type of product work that may not appear in a WBR is product market fit expansion work. Those that are truly zero to one initiatives. But once launched, they should be incorporated into your existing metrics dashboards as quickly as possible. Otherwise, you’re not operating at the intersection of solving customer problems and business value creation.

The second point I’ll make on this is that not every team will need to be part of the WBR. Product work is a portfolio and not everything will have an in-quarter, metrics-based result. But if you have key results that impact the growth model then you should be there.

The Weekly Business Review is a fantastic tool for fostering a metrics-oriented culture and one that indexes highly on solving problems and holding each other accountable. I’m hopeful that today’s newsletter helped you understand:

Why you should have a Weekly Business Review

How to set up and run one

How to manage them within and across teams

How to make your WBR a good use of time, actionable and what sort of actions you can take

If you’ve successfully or unsuccessfully implemented a Weekly Business Review at your company I’d love to hear from you. Write back and tell me about it!

Love these super-actionable articles. It's like learning by working for/with you!